All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The insurance firm invests it, generally in high quality long-lasting bonds, to money your future payments under the annuity. Bear in mind, the insurance provider is relying not simply on your individual payment to money your annuity.

If the business is on strong footing, any type of loss in their portfolio will not affect your payments. Your payments are taken care of.

These commissions are developed into the purchase cost, so there are no concealed costs in the MYGA contract. As a matter of fact, delayed annuities do not bill costs of any kind, or sales charges either. Sure. In the current environment of low rate of interest, some MYGA financiers develop "ladders." That means purchasing several annuities with staggered terms.

For example, if you opened up MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account developing every year after 3 years. At the end of the term, your cash might be withdrawn or put right into a new annuity-- with good luck, at a higher price. You can likewise use MYGAs in ladders with fixed-indexed annuities, a method that seeks to optimize return while also securing principal.

As you contrast and contrast pictures provided by various insurance provider, take into factor to consider each of the areas listed above when making your final decision. Understanding contract terms in addition to each annuity's benefits and downsides will certainly enable you to make the most effective decision for your financial circumstance. Assume meticulously about the term.

If passion rates have risen, you might want to lock them in for a longer term. This is called a "totally free look" period.

What Is A Structured Annuity

CANNEX is an independent firm that intends to give accessibility to and openness regarding the expense and features of retirement financial savings and retired life revenue products. March, 2025 Climbing U.S. Treasury returns have lifted the middle years of the price contour. Customers can get virtually the very same rate of interest (5.65%) for six years from the A-rated Oceanview Life as they can from for one year from GBU Financial (5.70%).

It is very important to check back for the most recent details. Web page 1 of 76 Previous Following Resource: Cannex, Mar. 05, 2025 GCU Insurance 1 + 4 Choice 4.25% 1 Years 5 Years A- Gain Access To SPDA 3.45% 6 Years 6 Years A- Gain Access To SPDA 3.25% 4 Years 4 Years A- Protection Advantage Life Insurance Policy Business Advanced Selection 5.25% 7 Years 7 Years A- Safety And Security Benefit Life Insurance Coverage Company Advanced Selection 5.25% 5 Years 5 Years A- Safety And Security Benefit Life Insurance Policy Business Advanced Choice 5.00% 3 Years 3 Years A- Advantage 5 Advisory 5.40% 5 Years 5 Years A++ American Life & Security Corp American Classic 5.05% 3 Years 3 Years B++ American Life & Safety And Security Corp American Standard 5.20% 5 Years 5 Years B++ American Flexibility Aspire 3 4.60% 3 Years 3 Years A++ Page 1 of 76 Previous Following Given that annuities and CDs are both thought about safe money options and operate in comparable ways, they are typically contrasted.

The percent by which the annuity grows gradually is called the annuity's price. "This rate identifies the size of the regular payments that the annuity holder will get once the annuity starts paying out," Jason Ball, a Licensed Financial PlannerTM professional, told Annuity.org. "Annuity rates can either be dealt with, indicating the price remains the same over the life of the annuity, or variable, which implies they can fluctuate based on the efficiency of underlying investments," Sphere claimed.

Because their returns are not determined by an ensured stated passion price for a collection duration, consumers will not find rates for these products when searching for the ideal annuity rates. It's likewise essential to bear in mind that the rate of an item is not the only variable worth taking into consideration when choosing between annuities.

Southern Baptist Convention Annuity Board

"However there are great deals of clients that would certainly be alright with a lower price if the business is greater rated versus a company that is a B++." Annuity prices are difficult to contrast because, as previously pointed out, various kinds of annuities earn passion in various methods. Typical set annuities ensure a passion rate for a 1 year term, whereas other taken care of annuities like MYGAs assure rates for 3 to 10 years.

Whereas, the set index annuity utilizes distinct attributing methods based on the efficiency of a stock market index. Contrasting annuity kinds can be bewildering to the average consumer.

Axa Equitable Annuity

In other words, this is when the round figure is transformed to a settlement stream. Immediate annuities, additionally known as revenue annuities or solitary costs instant annuities, transform premiums to a stream of revenue immediately. This does not suggest that the annuitant has to begin getting earnings settlements instantly. In truth, deferred income annuities (DIAs) are annuitized immediately, but settlements begin at a specified future day.

The accumulation duration is the 3rd container annuity providers use to classify these products. Immediate annuities have no accumulation period.

The interest prices for indexed and variable annuities rise and fall with the stock market. Income annuities (FIAs and DIAs) are typically priced estimate making use of either the monthly revenue settlement amount or an annual payout rate that stands for the portion of the premium quantity that the annuitant has actually gotten in revenue payments.

Their guaranteed rate of interest make them understandable when it concerns interest rates and the return they can provide over the contract term. Taken care of annuity rate quotes serve when contrasting annuities from various carriers. Several providers provide penalty-free withdrawal provisions, enabling the annuity owner to partly withdraw before the surrender period finishes without fine.

If you want the possibility of higher prices than what dealt with annuities provide and are willing to tackle even more threat, consider checking out set index or variable annuities. Consumers should identify how much they want to purchase an annuity, then look around to different highly rated insurance coverage firms (appearance for at least an A- score) to see what their prices are, and do window shopping, like you would when you purchase an automobile.

Death Benefit Rider Annuity

This is as a result of the means insurance firms buy annuity premiums to produce returns. Insurers' repaired annuity profiles are made up of fairly safe investments like bonds. So, when passion prices on bonds and similar products climb as they did throughout much of 2023 the greater returns insurance providers receive from their portfolios are passed to consumers as more generous fixed annuity rates.

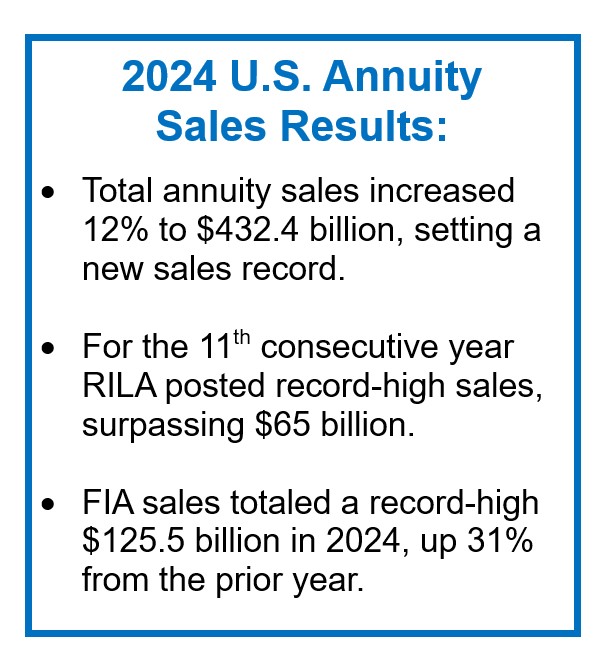

According to Limra, repaired annuity sales last year totaled $140 billion, with prices tripling over 18 months going back to 2022. "If rate of interest go up, it's expected annuities will certainly pay out a lot more," Branislav Nikolic, the Vice Head Of State of Research Study at CANNEX, told CNBC. Possible customers may be running out of time to take benefit of the appealing prices that are presently supplied by service providers.

This indicates that the presently high repaired annuity rates marketed may begin to decline as the year endures. Check out annuity items and rates. Annuity rates are set by the insurance coverage firm that issues the agreement. Fixed annuities have actually guaranteed rates of interest for a foreseeable revenue stream. These prices are set by the annuity firm and outlined in your agreement when you purchase.

Table of Contents

Latest Posts

Annuity Rankings

401k Annuities Rollover

Annuities Inflation Adjusted

More

Latest Posts

Annuity Rankings

401k Annuities Rollover

Annuities Inflation Adjusted